![[LIVE] BTC Surges Past 117k, Targets 119k Next, ETH Crosses $4000 Barrier: Top Cryptocurrency To Invest In Now [LIVE] BTC Surges Past 117k, Targets 119k Next, ETH Crosses $4000 Barrier: Top Cryptocurrency To Invest In Now](https://i3.wp.com/99bitcoins.com/wp-content/uploads/2025/08/Coinglass-Heatmap-Data-300x159.jpeg?w=770&resize=770,470&ssl=1)

[LIVE] BTC Surges Past 117k, Targets 119k Next, ETH Crosses $4000 Barrier: Top Cryptocurrency To Invest In Now

On August 7, 2025, Bitcoin bulls facilitated a rapid rebound, recapturing the 117k level following a brief decline beneath the Bollinger Band support, which analysts are describing as a classic “head fake” reversal, sparking renewed bullish enthusiasm as the leading digital currency to acquire at this moment.

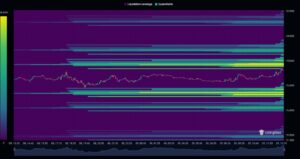

With bullish sentiments rekindled, traders are setting their sights on the 119k threshold as the next significant price ceiling area. Additionally, the BTC heatmap data indicates market fluidity clusters between $117.5k and 118k, suggesting a potential gradual climb as traders persist in unwinding short positions.

Furthermore, the daily CME futures gap has been closed, creating a fresh support level near $114k. Notably, a divergence is developing between spot price movements and ETF inflows. Bollinger has identified this setup as a potential trap for overly aggressive bears.

As per CoinGlass’s heatmap data, Bitcoin is facing increasing resistance in the liquidation clusters forming between 117.5k and 118k. Conversely, market demand is building around the 114k level, which has been bolstered by the resolution of the CME futures gap.

This level has historically acted as a crucial convergence point for spot prices, further validating its role as a support zone.

$BTC liquidation map indicates a significant long cluster near ~116000 (left) and a short cluster around ~118000 (right). These zones function as price magnets, potentially driving market fluctuation. Config: optical_opti. pic.twitter.com/iJDczuolzG

— TheKingfisher (@kingfisher_btc) August 9, 2025

Analysts are anticipating that if BTC can surpass the 119k level, $120k will emerge as the next crucial target both from a psychological and technical standpoint.

Explore: Top Solana Meme Coins to Acquire in August 2025

ETH Targets $4500! Is It The Prime Crypto To Buy Now?

In the past 24 hours, ETH has faced $229.49 million in futures liquidation, with CoinGlass’s data revealing $22.24 million eliminated from longs and $207.25 million from shorts. After bouncing off base level around $3,470 last week, ETH has surged 15%, reclaiming the $4000 level for the first time since December 2024.

Currently, Ethereum encounters resistance at the $4100 level, characterized by past selling pressure and a descending trendline extending from its November 2021 all-time peak.

A upward movement above the $4100 mark could initiate another optimistic rally, potentially propelling ETH toward the $4500 level, a critical barrier level region prior to revisiting its all-time high of $4,868.

In the meantime, it must safeguard its $3470 support to maintain this optimistic momentum. A weekly close below this threshold might prompt a decline towards $3220, and if that fails, the $3000 psychological price floor area could come into play.

Momentum indicators, including the RSI, are flashing caution as ETH approaches the overbought zone, while the Stochastic Oscillator has remained overbought since June. While current signals suggest uptrend momentum, the potential for a short-term pullback should not be dismissed.

$ETH: Looks great at this point, hitting the highest price since December 2021. This is a breakout across multi-year price ceiling. It could leap to 5k and subsequently re-test 4k as support. https://t.co/KdV98aYjvM pic.twitter.com/1qDPl7YaID

— Christian Ott (@ChrisOtt) August 9, 2025

On a positive note, Ethereum has appreciated over 180% since reaching a recent low of $1385 in April, rallying by more than 60% in the last month. This recent performance has been driven by substantial buying interest from corporate entities shifting towards ETH treasury.

Additionally, on August 5, 2025, it received a regulatory endorsement from the SEC (Securities and Exchange Commission) after the regulatory body clarified that liquid staking of crypto assets does not violate securities law.

Explore: 10+ Crypto Tokens That Have the Potential to Reach 1000x in 2025

No live updates are currently available. Please check back later!

The post [LIVE] BTC Breaks Above 117k, Eyes 119k Next, ETH Breaks $4000 Mark: Prime Crypto To Acquire Now appeared first on 99Bitcoins.