Over $1T Wiped From The Market But Bitwise Says Crypto Winter Is Near Its End

Bitwise CIO Matt Hougan recently described the crypto market as locked in a full-blown winter since January 2025. A brutal, 2022-style downturn driven by excess leverage, widespread profit-taking by early holders, and sustained price pressure across the board. He likens it to “Leonardo DiCaprio in The Revenant”: harsh, prolonged, and not just a routine pullback.

Institutional ETF inflows and treasury adoption masked much of the damage for months, keeping surface optimism alive while retail and altcoin holders faced steep drawdowns.

I visited a bunch of financial advisors this week and can confirm they're still generally bullish. Those who haven't invested yet see the pullback as an opportunity and those who bought earlier plan to hold.

That said, if there is one thing this pullback has taught us, it's that… https://t.co/SCi7POOuaC

— Matt Hougan (@Matt_Hougan) February 5, 2026

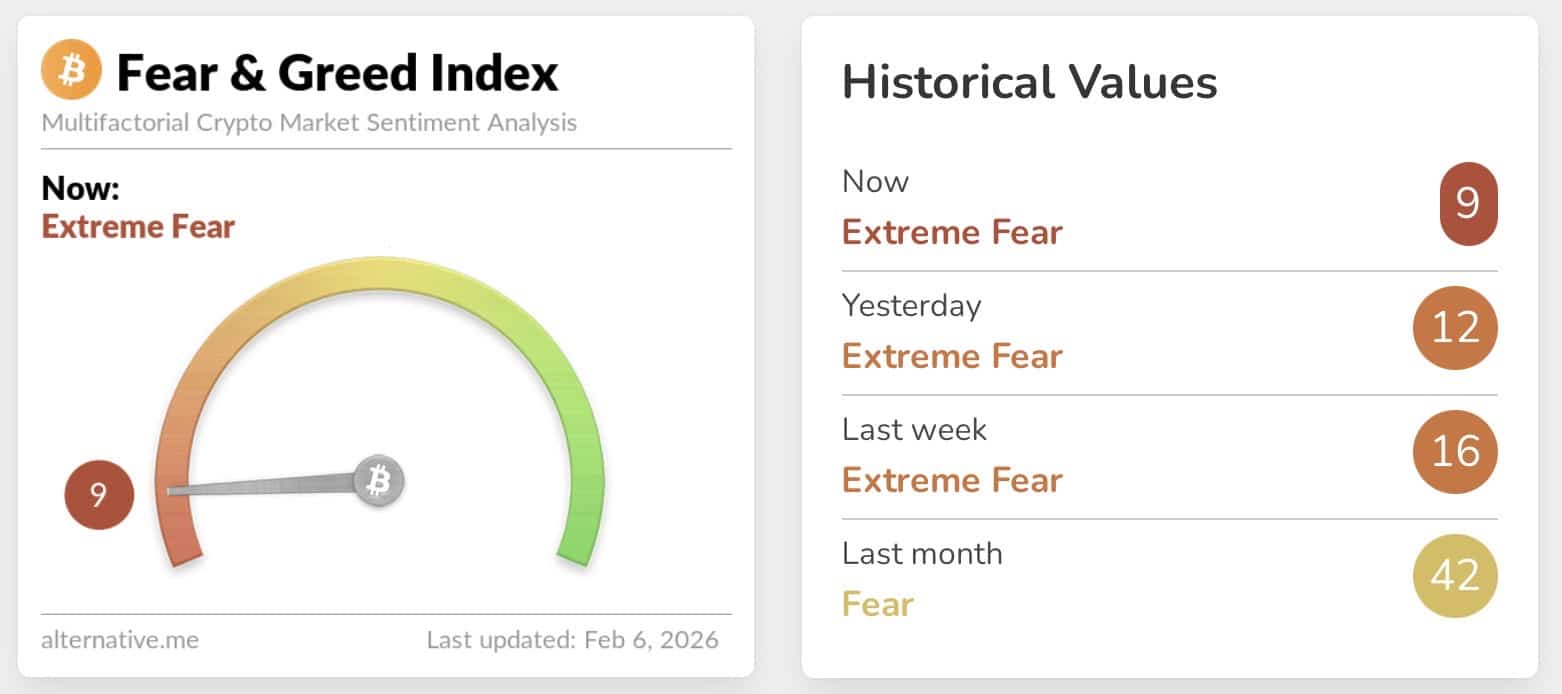

Bitwise Says the Worst Has Passed as Crypto Fear Index Drops to 9

Bitcoin has shed about 39% from its October 2025 all-time high, Ethereum over 50%, and many large-cap altcoins 60-75%. Hougan highlights classic late-winter signals: extreme fear dominating sentiment, grinding lower prices, and total exhaustion among traders.

Historical crypto winters average around 13 months from peak pain to recovery; with this one starting early 2025, he argues we’re closer to the thaw than the freeze, potentially setting up for a rebound “sooner rather than later” as capitulation exhausts itself.

The Crypto Fear & Greed Index now sits at 9 (Extreme Fear territory), one of the lowest readings in years.

DISCOVER: Best Meme Coin ICOs to Invest in 2026

February 5 Flash Crash Hits Hard – $2.6 Billion In Liquidations

Yesterday delivered one of the most violent sessions since the 2022 FTX implosion. Bitcoin plunged as much as 15-17% intraday, briefly tagging lows near $60,000-$63,000 before clawing back somewhat. It closed down over 10-12%, now trading around $65,000. Ethereum mirrored the pain, sliding into the low $1,800s-$1,900s.

Global crypto market cap shed hundreds of billions in that single day, adding to over $1 trillion erased in recent weeks and up to $2 trillion from October 2025 peaks near $4.379 trillion.

Futures liquidations exceeded $2 billion, overwhelmingly longs getting rekt in the cascade. On-chain metrics show leveraged degens flushed out, again.

(Source: Coinglass)

EXPLORE: Best New Cryptocurrencies to Invest in 2026

Binance Doubles Down on BTC Accumulation

In all this chaos, Binance is executing its $1 billion SAFU-to-BTC conversion plan. Two recent $100 million batches (February 2 and 4) swapped stablecoins for roughly 2,630 BTC in total so far. Why are they buying more Bitcoin? Beyond increasing their crypto reserves, a more psychological motive may be to counter the intense FUD targeting Binance and its founder, Changpeng Zhao (CZ), especially after the 10/10 crash that caused severe damage across the industry.

People are accusing Binance of several things:

- Claims Binance is insolvent or facing a bank run, with fake screenshots, forged cease-and-desist letters, and calls for mass withdrawals.

- Blaming CZ/Binance for the ongoing ~50% BTC correction (from ~$126K ATH to ~$63K-$65K), labeling CZ as the “SBF of this cycle” or worse.

- Allegations of market manipulation via SAFU conversions (buying low to benefit themselves), plus coordinated paid FUD campaigns (e.g., offers to influencers to bash Binance).

CZ has repeatedly pushed back on X, calling it “imaginative” or “twisted FUD,”.

Some see the SAFU-to-BTC move as a reaction to criticism and perhaps an attempt to defuse sentiment within the crypto community. Given Binance’s position as the leading crypto exchange, it’s unsurprising that it faces more criticism than other platforms.

In any case, Binance now has a chance to accumulate Bitcoin at deeply discounted levels, assuming the crypto market avoids another trillion-dollar wipeout in the coming months.

Bitwise says the worst is oberAfter over a year of winter, extreme fear at 9, and visible capitulation, cycles suggest that the bottom might be near.

DISCOVER:

Follow 99Bitcoins on X For the Latest Market Updates and Subscribe on YouTube For Daily Expert Market Analysis.

The post Over $1T Wiped From The Market But Bitwise Says Crypto Winter Is Near Its End appeared first on 99Bitcoins.